Since the 2008/2009 “Great Recession,” financial gurus of every kind predicted another major deep downturn, perhaps greater than that of 1929-33. What they have actually spoken of is the country that ‘drives away from financial cliffs,’ and mainly attributed it to the failure of Congress to raise the national debt.

The trigger which causes us to break the financial cliff is the difference in these financial predictions. This is a constantly changing objective as it changes every time another trigger passes through us without causing the disaster expected.

But the underlying problem is still there, that is likely to cause the financial collapse. Our economy is essentially on a very wavering scale, and it is a land never before trampled on.

The fact that the US dollar is the world reserve currency is part of what has sustained our economy to this point. Virtually all international transactions in dollars are carried out. Each nation and international company around the world is forced to buy dollars by this simple fact

In addition to that, the Federal Reserve releases essentially thin air money as “quantitative easing.”

Although the money pool needs to be increased in response to an increasing population and a growing economy, this is mainly done to support government commitments that are not taxed.

This is money made up to pay for things, in other words, because there is no money for them to pay.

This is what inflation is all about, not companies that charge more for their products. Businesses increase prices because they have to buy more material; in other words, they react to inflation that perpetuates the cycle in turn.

Related: What Could Happen In One Year If The Economy Does Not Restart

The Reality

The truth is that every time the Federal Reserve creates more money, the value of every dollar that exists dilutes.

Every dollar is essentially a percentage of our economy’s total value.

As they create dollars constantly faster than economic growth, the value of the dollar is decreased. This is just so slowly happening that we can’t look at it.

Surprisingly, the Fed’s quantitative easing did not, as usual, cause massive inflation. On Wall Street, which economists consider good is, we see about the only place where massive inflation is.

But that doesn’t mean it’s all right. The card house will collapse sometime and possibly even earlier than anybody expects.

Some economists now try to say that our national department is “too low” and that our economy can sustain much more. What they really say is that they believe that the world will support holding much more US debt, which enables the government to borrow even more.

The Coronavirus Relief Act was perhaps the most scary event that showed how far our Government is from a limb.

In one single stroke the Congress authorized the production of an additional 2.2 trillion dollars of funny money for different entities, including you and me, to try to prevent the COVID-19 pandemic from becoming a major financial catastrophe.

Now that they’ve done so once, there’s nothing to stop them to do it again. What nobody seems to have found out yet. The real question is how many times will this happen, before it is the trigger not only for the US economy, but the world economy.

Normally, the rest of the world’s economy remains intact when countries have a financial collapse. It promotes them and enables them to reconstruct. But when America has a hiccup in our finances, it affects the world as the largest economy in the world.

It is not only the US economy but the entire world economy that is affected by the Great Depression. Similarly, in 2008/2009, the housing bubble exploded as well.

When we enter the next depression, there won’t be anybody to rescue us. Thanks to us, everyone will try to bail themselves out.

Related: 10 Expenses You Need to Cut Now for the Upcoming Economic Depression

What Should We Do?

We have to prepare ourselves for this while we are sure that there will be another great depression, even though we don’t know when it is due. Everyone doesn’t lose their jobs and lives by a depression destroying them, everyone is affected.

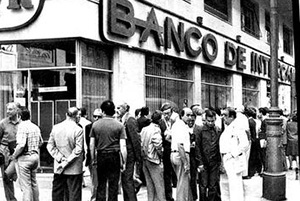

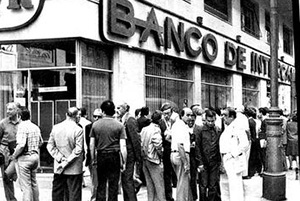

As a model for what we could expect in the fall of our own economic crisis, Argentina’s 1999 collapse saw inflation exceed 2000%, with peak months alone showing an inflation of 200% in one month.

Wages rose by less than 250% in the same collapse.

Those who made the best found their money not going anywhere and their buying power decreased greatly.

Those who work in the luxury industries and those who are heavily indebted were the two most seriously affected by the collapse.

Luxury products, not even to the rich, stopped selling completely. Then shut down plants and stores that sold these goods. At the same time, those who were heavily in debt couldn’t make their payments and lost everything, including their homes.

Therefore, we don’t want to be part of those groups. On the other hand, people who lived off their land in the country, did good, few of them either dropped out of home or became hungry.

Get A Secure Job

It is time to go out of business, especially if you work in an industry where the economy is highly affected, in which luxury goods sell. Find something safer, such as food industry work or repair.

When the economy goes south, people stop buying new products, keep old products and spend money to repair them. Thus, some of the safest jobs around are repairing computers, appliances and cars.

Although some teachers have lost their jobs at the 2008/2009 hitch in our economy, many of the typically secure jobs will also remain secure, including work in the medical field and governmental activities.

Related: How To Buy Good Stuff Inexpensively

Get Out Of Debt

Do whatever you can to remove debt in your life.

While some debt might be there, like your home mortgage, you can’t get away from it, make sure your mortgage isn’t higher than it should be.

Downsize, if possible, sell your house and move into a smaller one, reduce your mortgage. If not, see refinancing, to see whether it will save you money.

Above all, you want to get rid of other kinds of debt, because they make it more difficult for you to pay your house.

If your mortgage is the only debt you have, you are more likely to pay it. But if you pay for two cars, debt on the credit card and furniture for the living room, you’ll be in trouble.

Move, If You Can

In the middle of a financial crisis, a farm is the safest place. If you cannot buy a small farm or a house, it’s a good second choice to live in a small rural community.

It is not only cheaper to live there, but they are also often at lower rates of crime.

In times of financial crisis, crime will always spike as people who otherwise obey the law get desperate and turn to crime to get what they need.

Although the cities were massively short of food, there was plentiful food on the farms during the Argentine collapse. The problem was not production; it was transportation and sale costs. Inflation was so bad, it was impossible for businesses to afford to buy food.

If the food could be sold right away, it wouldn’t provide them with enough money to restock what they could sell for.

It’s also easier to move to the country to get the next thing that we must do.

Related: The Best Places To Live Off The Grid

Become Self-Sufficient

The cheapest way for your family to feed is to grow your own food. Although you are perhaps less diverse and miss many of your favorites, you will at least have food to eat.

This is an important part of your family’s survival with the high potential for food shortages as I mentioned above.

Historically, farms and homesteaders were the least affected by any economic vagaries. Although they may not have had much wealth, they always had enough to eat. For that, there’s plenty to say.

Be Ready To Defend Yourself

Be prepared to defend your family and household. As I said before, in times of financial difficulty, crime rates tend to increase. Much of this happened during the collapse of Argentina, as people fought to survive.

People quickly learned not to open their doors unless they knew somebody.

Still, before opening the door, they would check out the area around their homes and look for someone else not there.

Someone rushing through the door while it was open always had a chance.

They also learned not to stop at a red light unless an accident had to be avoided. Stopped vehicles became goals, with criminals opening windows in order to capture what they could or try and hijack the car.

Enlistments were then turned into a cottage industry, with rich people’s children as their primary goals. But the only ones were not. Anyone with a home was rich for those who were desperate. Without an armed adult standing by to look over and protect them, children could not play outdoors.

Don’t Forget To Stockpile

Finally, we return to the foundation of any prepping, stockpiling. Food can very well be the best investment possible, because food prices will lead to inflation.

It could just be what keeps your family eating while everybody else struggles to meet the end of a good stock, going into the depression.